For more than a year, SCHD ETF has become a reliable source of income for diversified investors through dividend compounding. The Schwab U.S. Dividend Equity ETF (SCHD) has established its place in many long-term portfolios because it has successfully provided good dividends to its investors. But as we get closer to 2025 SCHD is going through its annual reconstitution which is causing a lot of talk in the investing community.

In this article we will explain in detail about the SCHD Reconstruction 2025. We’ll talk about the changes that are coming, why they are happening and how they will affect long-term investors. This detailed breakdown will help you understand the new-look SCHD and its potential for future returns and therefore whether you are a seasoned investor or just thinking about investing in it for the first time.

What Is SCHD ETF Reconstitution?

SCHD Reconstitution 2025 refers to the ETF’s holdings being updated periodically to those of the underlying index. SCHD tracks the Dow Jones U.S. Dividend 100 Index which measures the performance of high dividend-yield U.S. stocks with a history of consistently paying dividends. It helps the ETF keep pace with the index’s parameters such as dividend payout and financial strength. That means building positions in new stocks and selling those that no longer make the grade for the index.

The annual reconstitution ensures that SCHD must follow the most current index by removing the underperforming stocks that don’t pay dividends consistently and adding stocks that meet the quality criteria. This means that about 20-25% of the holdings each year.

This is essential for SCHD because it aligns with the fund’s objective of offering investors high-quality, dividend-producing companies. The reconstitution helps to enhance the ETF’s performance and adjust to market conditions.

SCHD Reconstitutes 2025 Date and Time Table

The SCHD reconstitution 2025 will occur in the middle of March. And the timing is favorable because it allows the ETF managers to factor in the latest market information in the decision process. The reconstitution is done in the following major steps:

| Time Period | Action/Description |

| January-February 2025 | ETF managers evaluate financial performance and other measures at companies in the index. |

| March early 2025 | The index committee completes the list of stocks that will be added or removed which is based on the criteria. |

| Mid-March 2025 | Final adjustments are made and the new fund is made official and public.(officially March 21–27) |

So if you are an investor, then it is advised that you must be informed about this reconstitution timeline as it can have potential impacts on the ETF’s performance and risk characteristics. Therefore if you understand these then it helps you to take your steps accordingly.

How Reconstitution Impacts SCHD Investors?

SCHD’s reconstitution has significant ramifications for dividend investors. The goal of the ETF is to generate a steady cash flow with dividends and how reconstruction may affect the following:

1. Dividend Yield:

After SCHD reconstruction 2025, the yield of the ETF will range between 3.75% and 4.26% for the last 12 months. This means that the ETF is providing a return of this percentage based on the stocks it holds. The reason for this range is that the ETF now includes those stocks that give higher returns (dividends) but it still focuses on keeping high-quality stocks in the mix. This adjustment aims to optimize the income generation potential for investors.

2. Dividend Growth:

The ETF still focuses on companies that have a history of increasing their dividends. Over the past 12 months it has grown by 8.6% year on year. For example in Q1 2025 the quarterly dividend payouts showed a 22% year-over-year increase in Q1 2025.

This strong growth in dividends shows that SCHD is committed to finding and holding companies that not only pay dividends but also consistently raise dividends by giving investors a growing income stream.

3. Income Stability:

SCHD reconstruction 2025 promotes stable dividend income by diversifying its investments into different sectors and rebalancing them on a regular basis even when some sectors are volatile. But investors should know that income stability can still be affected by macroeconomic and sector-specific factors.

There is one point that we want to raise especially for those who are dependent on SCHD for income: Keep an eye on the reconstitution process as that will most likely bring changes in the dividend yield and the stability of the income.

Why SCHD Rebalances in 2025?

As SCHD’s index is refreshed and updated, some stocks will be deleted, and others will be added. Here’s a brief rundown of what one might expect in the 2025 reconstitution:

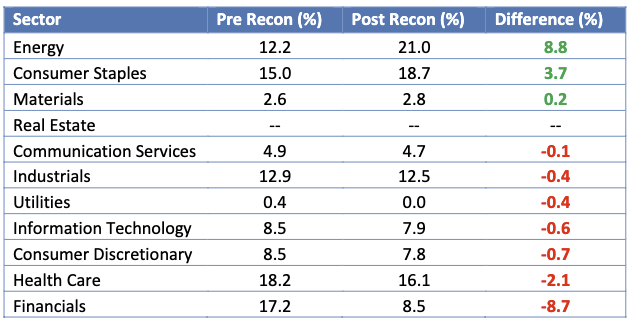

1. Sector Weight Shifts:

Due to the SCHD reconstitution 2025, the weight of the energy (+3.2%) and consumer staples (+1.7%) sectors has increased but the weights in the technology and industrials sectors have gone down (-4.2% and -4%, respectively). This was supposed to make income more stable but it also brought risks that were specific to certain sectors.

2. Stock Addition:

Stocks with a record of consistent dividends growing over time will be added, as well as those that satisfy the other screening criteria. For instance, large-cap businesses with established earnings and a track record of robust dividends are listed in the new reconstruction criteria.

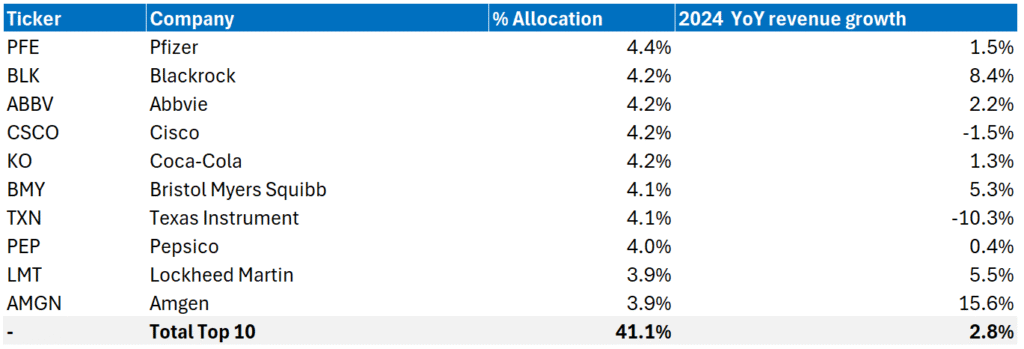

3. Stock Removal:

The stocks that are now underperforming in providing dividends were removed to maintain focus on reliable firms. For example: BlackRock, Pfizer, US Bancorp, KeyCorp, H&R Block, Tapestry and DICK’S Sporting Goods.

Such changes can result in large changes in the ETF’s risk characteristics and performance. These kinds of changes are very important for maintaining the ETF’s integrity and performance goals, but it can also change the ETF’s overall risk and performance.

Top 10 Holdings After SCHD Reconstitution 2025

After the March 2025 SCHD reconstruction, the top 10 holdings will match the new sector weights. This means that energy, healthcare and consumer goods companies will dominate a bigger portion of the holdings.

| Holding | Weight (%) | Sector |

| Chevron (CVX) | 4.34 | Energy |

| ConocoPhillips (COP) | 4.26 | Energy |

| PepsiCo (PEP) | 4.20 | Consumer Staples |

| Amgen (AMGN) | 4.11 | Health Care |

| Merck (MRK) | 4.11 | Health Care |

| Cisco Systems (CSCO) | 4.06 | Technology |

| Bristol-Myers Squibb (BMY) | 3.90 | Health Care |

The precise top 10 may vary, as holdings change and markets move, but it’s a good bet that those companies will continue to make up some of SCHD’S most influential positions.

So the goal of this strategic reallocation is to make the ETF more stable and able to make more money.

SCHD vs. The Competition Post-Reconstruction

So how does the new SCHD compare to its competitors? Below I am explaining how SCHD stands up against other well-known dividend ETFs such as VYM and DGRO:

| ETF | Dividend Yield | Key Strength |

| SCHD | 3.7% | Dividend growth |

| VYM | 3.5% | Broad diversification |

| DGRO | 3.3% | Dividend stability |

Performance and Risk Profile Effects

The yearly reconstitution of SCHD is meaningful in terms of both performance and risk considerations. Here is how:

1. Performance Impact:

The 2025 SCHD reconstitution helped SCHD stay aligned with market trends and what investors want by removing those companies that were paying less dividends and adding companies that were growing their dividends quickly. By doing this, the total returns and sustained dividend income will improve.

2. Risk Profile:

The risk profile of SCHD changes when it is reconstructed because of the sectors and companies that increased their holdings. Most investors usually think of risk here in terms of price volatility (how much the ETF’s value changes) and income reliability (the chance of getting steady or rising dividends).

As you may know that the 2025 reconstitution significantly shifted its investment from the more cyclical or potentially unstable areas like technology and financials into energy and consumer staples.

When you reduce the percentage of holdings in the tech and financials then you usually have less exposure to sectors where earnings and dividends may go up and down a lot during economic booms and busts. On the other hand, consumer staples mean food and household goods companies will make strong profits and pay dividends because demand for them doesn’t change.

Another part of the risk is the energy, which is more complicated. Most investors traditionally see it as unstable because of changes in commodity prices but there are some specific energy companies that SCHD owns are blue-chip giants that have a history of raising dividends even when things are not good.

3. Diversification:

Annual reconstitution ensures that SCHD has a wide range of stocks and sectors. This means that the performance of the SCHD ETF stays steady for a long time and it is less likely to be affected by shocks from any one company or industry.

Conclusion

SCHD 2025 reconstitution is an important situation to keep in mind for investors. This ensures that the ETF always represents a tight cluster of the most stable and highest-performing dividend stocks, boosting the ETF’s potential for dividend income and long-term growth. So it tells that investors can make more informed decisions and modify their strategies by tracking the reconstitution process. So if you want to get more dividends out of your investment in 2025 then you need to know how SCHD’s reconstitution works.