One of the best ways to build your wealth over time is through long-term investing with dividend reinvestment plans or DRIPs. It is like a strategy where you set it up and forget about it. You only have to invest once and your dividends will quietly buy you more shares every three months from the dividend you earn. This will continuously build a snowball of returns for long-term prospects.

But here is the problem that a lot of investors have a little idea of a DRIP but most of them do not know how to read the actual DRIP statements. There are so many numbers, line items, and tables on the page that new investors feel confused. However the DRIP statement can be one of the most interesting things to read once you know how to read it. It tells you the real story of your investment as it grows and showing you how dividends go back into more shares and how each quarter brings you closer to your financial goals.

This guide will clear all your confusion regarding the DRIP statement and explain it to you step by step. By the end you will know exactly how to read it, keep track of your progress and see how amazing dividend compounding really is.

First, What Exactly Is a Dividend Reinvestment Plan (DRIP)?

To invest in companies with a DRIP you can purchase shares directly from the company and then you have to reinvest your dividends in those companies (called a Dividend Reinvestment Plan) by automatically buying more shares from the same company rather than receiving a cash dividend.

What are the Core Benefits of Using DRIP?

1. Automated Growth: Once you enrol in a DRIP, your dividends are automatically reinvested, so you do not have to do anything. The process is completely done automatically.

2. Compounding Returns: Your new shares also start paying dividends with DRIPs. These dividends are then used to buy even more shares. This has a compounding effect that speeds up the growth of your investment over time.

3. Cost-Effective: Most DRIPs don’t charge more brokerage fees from you to buy more shares so you can invest more of your dividend income. This is a better way to grow your portfolio by reinvesting your dividends.

Important Risks and Considerations When Using a DRIP

Even though DRIPs have many benefits, such as automatic growth and compounding returns but it is also important to know about the risk factors before making an investment decision.

1. Concentration Risk: Because DRIPs are reinvested dividends in the same company and so your portfolio may become too concentrated which makes it riskier if that company performs poorly.

2. Dividend Reductions: Companies sometimes can reduce or suspend dividends which implies that reinvestments may stop and slow your portfolio growth.

3. Market Volatility: The price of the reinvested shares can change due to market fluctuations which means that the value of your investment can go up or down.

4. Valuation risk: Because reinvestment is automatic and you keep buying shares even when the stock is over-valued and the over-valued stock will potentially reduce your future returns.

5. Tax Complexities: Even if you don’t receive any cash dividends then you still have to pay taxes on them. For correct tax reporting, it is necessary to keep accurate records of reinvestment transactions and cost basis. And if you make a mistake, it can lead to paying too much in taxes as a penalty.

Why You MUST Read Your Dividend Reinvestment Plan Statement

Your DRIP statement is more than just a piece of paper. This paper is like a report card for your investments and it is very important to read your Dividend Reinvestment Plan (DRIP) statement because it has important tax information, you can track your investment to see where your money is going and helps you keep an eye on portfolio concentration risks that could have a big impact on your financial situation.

1. Verify Transactions:

If you sign up for a DRIP then your cash dividends are automatically used to buy more shares and it is often at a discount and sometimes you will get them without a fee. But this statement report and if they make a mistake in delivering the proper number of shares through DRIP then you can use this statement as proof and raise your complaint against it. In this statement you will check how much reinvestment is to be done through DRIP along with the number of shares you bought, the price and the date.

So it means that your statement report is your first line of defence if something goes wrong with the reinvestment process like missing a dividend or buying shares at the wrong price. And after receiving the statement report, you must cross-check the statement and check if there are any mistakes before starting the compounding of the new shares. And if you are regularly checking your DRIP statement then it ensures you maintain an audit trail for your investment and it helps you know that your portfolio is growing as expected.

2. Track Your Growth :

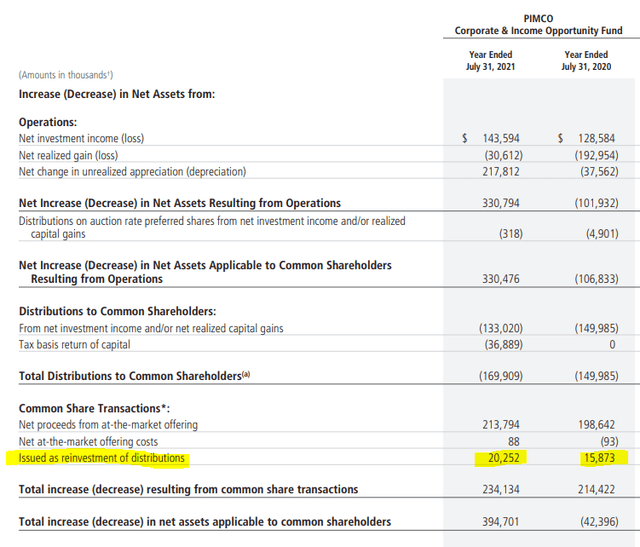

The real power of a DRIP is compounding. Here with the help of reinvested dividends you can buy new shares and these new shares also generate more dividends. Again with the help of these dividends, you can buy even more shares and so on. So even if you never put more money into the investment then this cycle can greatly increase your holdings over time.

For example, if you have 1,000 shares and you get $1 per share as a dividend annually that means 1000 shares you will get $1,000 dividend and using this amount you might purchase 20 additional shares. This means that next year’s dividend will be based on 1,020 shares. Your statement shows that this snowball effect occurs by showing how your ownership grows without any additional cash investment from you.

3. Essential for Tax Time:

Your DRIP statement has important cost basis information like the price you paid for each batch of new shares. This is probably the most important thing. This information is very important because dividends that are reinvested are taxable income even if you never get any cash. You have to report these dividends as taxable income in the year you get them, even if you reinvest them.

The cost basis from your statements will help you figure out your capital gains when you finally sell your shares. If you don’t keep accurate records of your cost basis then you could have a lot of trouble with your taxes or pay too much. The statement shows exactly when shares were bought and how much they cost through reinvestment. This is the proof needed for accurate tax reporting.

4. Long-term Investment Value

Your DRIP statement also shows how powerful it is to build up without paying any commissions. Most DRIPs allow you to buy more shares without paying any fees which means that more of your dividend goes directly into your portfolio. Some plans even tell you to buy shares at prices that are lower than the market rate.

How to Read a Dividend Reinvestment Plan Statement – Breaking it Down Section by Section

A dividend reinvestment plan (DRIP) statement is a full record of how dividends were automatically turned into more shares and this report also shows you the complete transaction process and your updated holdings.

1. The Account Summary

The account summary is the top part of the page that has all of your important identification information. This part makes sure you’re looking at the right account and time period. You should make sure that the name and address of the person who holds your account match what is on file with the bank. Any differences could mean that there were mistakes in processing. Your account number is what makes you unique in the DRIP system. The statement period (for example, July 1, 2025 to September 30, 2025) tells you what time the transactions shown took place.

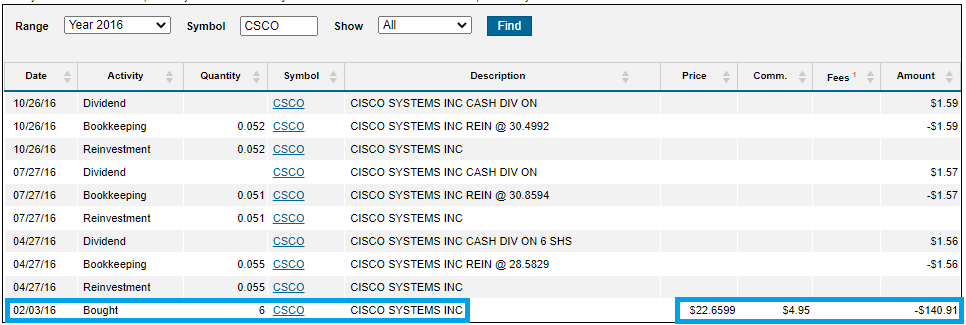

2. The Transaction Activity

This is the most important part where you can read the full story of your reinvestment activity in the dividend reinvestment plan statement. The line for “dividend paid/credited” shows how much cash dividend you earned from your existing shares during the time period. The reinvestment price shows the exact price per share at which your dividend was used to buy new stock. This price may include discounts that some companies give to DRIP participants which can be as much as 15% below the market price.

The shares that you bought/reinvested entry shows the exact number of new shares you bought with your dividend. This number is often a fraction like 1.452 shares because dividends don’t always match up perfectly with whole share prices. The fees/commissions line usually shows $0 which is one of DRIP’s main benefits and you don’t have to pay the fees that come with buying shares through brokers.

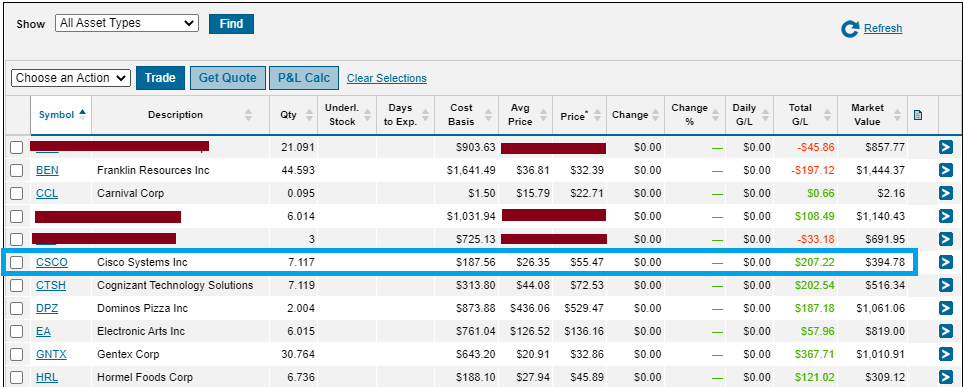

3. The Holdings Summary

The holdings summary gives you a full picture of your ownership position before and after. The beginning share balance tells you exactly how many shares you had at the start of the statement report. Your new and increased number of shares is shown at the end of your share balance. It is the same as your beginning balance plus the shares you bought through dividend reinvestment.

Conclusion

So it is very important to know how to read your DRIP statement. Above it explains in a detailed way that could be hard to understand into a simple and exciting method for your investment journey. And you take some time to read over your most recent DRIP statement and practice finding these important parts. This will help you become a more confident and knowledgeable DRIP investor.

Frequently Asked Questions

Why do I see fractional shares on my DRIP statement?

×Because your dividends are fully reinvested, and with the help of these dividends you can buy more shares. This is one of the best things about DRIPs. You can build up fractional shares over time and as your dividends grow so does your number of shares also grown.

How does reading my DRIP statement help with my taxes?

+When you reinvest your dividends then you get a new tax lot with a specific purchase price which is your cost basis. When you sell the shares then you will need your DRIP statement to figure out how much you owe in capital gains tax.

Is a DRIP the best strategy for long-term investing?

+A DRIP is a very effective strategy especially for passive investors who want to take advantage of the way dividends build up over time. But it is just one of many good ways to invest. It is a simple and cheap way for long-term investors to grow their money.