If you are an investor who wants a steady stream of income then the dividend yield of an ETF like SCHD (Schwab U.S. Dividend Equity ETF) is something you should think about. The dividend yield of SCHD is the percentage of the fund’s stock price that it gives shareholders as dividends. People who depend on passive income from their investments need this money.

SCHD Dividend Yield Overview

The SCHD annual dividend yield usually falls between 3.5% and 4.0% as of 2025. This percentage could change depending on the market but SCHD is known for having a higher yield than other dividend ETFs. It is one of the reasons why SCHD is still a popular choice for investors who want to make money.

In March, June, September and December SCHD pays dividends. This quarterly payment plan is great for investors who like to get cash on a regular basis either for immediate use or to reinvest through a Dividend Reinvestment Plan (DRIP)

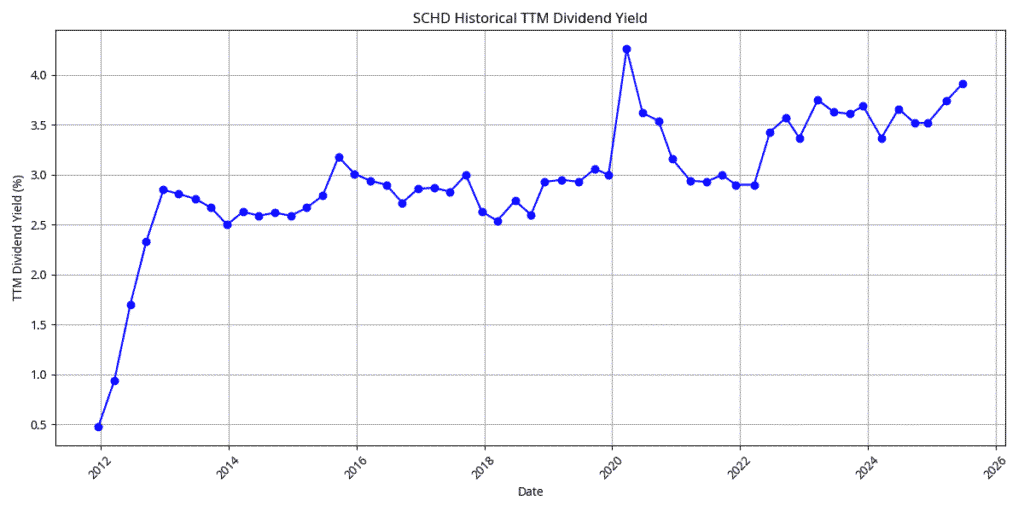

SCHD Historical TTM Dividend Yield

Below I am sharing a comprehensive view of SCHD’s dividend history, including individual quarterly payments, total annual dividends, and year-over-year growth rates. This helps you understand and quickly compare short-term distributions and long-term dividend growth trends.

| Dividend Date | TTM Yield |

|---|---|

| 2011-12-19 | 0.48% |

| 2012-03-19 | 0.94% |

| 2012-06-18 | 1.7% |

| 2012-09-17 | 2.33% |

| 2012-12-24 | 2.85% |

| 2013-03-18 | 2.81% |

| 2013-06-24 | 2.76% |

| 2013-09-23 | 2.67% |

| 2013-12-23 | 2.5% |

| 2014-03-24 | 2.63% |

| 2014-06-23 | 2.59% |

| 2014-09-22 | 2.62% |

| 2014-12-22 | 2.59% |

| 2015-03-23 | 2.67% |

| 2015-06-22 | 2.79% |

| 2015-09-21 | 3.18% |

| 2015-12-21 | 3.01% |

| 2016-03-21 | 2.94% |

| 2016-06-20 | 2.9% |

| 2016-09-19 | 2.72% |

| 2016-12-19 | 2.86% |

| 2017-03-20 | 2.87% |

| 2017-06-19 | 2.83% |

| 2017-09-18 | 3.0% |

| 2017-12-18 | 2.63% |

| 2018-03-16 | 2.54% |

| 2018-06-26 | 2.74% |

| 2018-09-25 | 2.6% |

| 2018-12-12 | 2.93% |

| 2019-03-20 | 2.95% |

| 2019-06-26 | 2.93% |

| 2019-09-25 | 3.06% |

| 2019-12-12 | 3.0% |

| 2020-03-25 | 4.26% |

| 2020-06-24 | 3.62% |

| 2020-09-23 | 3.54% |

| 2020-12-10 | 3.16% |

| 2021-03-24 | 2.94% |

| 2021-06-23 | 2.93% |

| 2021-09-22 | 3.0% |

| 2021-12-08 | 2.9% |

| 2022-03-23 | 2.9% |

| 2022-06-22 | 3.43% |

| 2022-09-21 | 3.57% |

| 2022-12-07 | 3.37% |

| 2023-03-22 | 3.75% |

| 2023-06-21 | 3.63% |

| 2023-09-20 | 3.61% |

| 2023-12-06 | 3.69% |

| 2024-03-20 | 3.37% |

| 2024-06-26 | 3.66% |

| 2024-09-25 | 3.52% |

| 2024-12-11 | 3.52% |

| 2025-03-26 | 3.61% |

| 2025-06-25 | 3.81% |

You can use the SCHD Dividend Calculator to see how your investment in SCHD will grow over time. This tool helps you figure out how much money you could make each year and each quarter based on how many shares you own. Investors can use this tool to better plan their financial future and figure out how much money they might make from their SCHD investment.

SCHD Dividend History

One thing that makes SCHD stand out is that its dividends have grown steadily over time. Therefore you can also check your dividend history performance on the basis of your investment in the SCHD ETF then you can understand it in a more detailed way.

- In 2021, SCHD paid an annual dividend of approximately $0.71 for each share.

- This went up to $0.91 per share in 2022.

- The annual dividend had grown to $0.89 per share by 2023.

- In March and June 2025, SCHD paid its quarterly dividend at $0.2488 per share and $0.2602 per share, respectively.

This upward trend shows that SCHD is serious about rewarding its shareholders. The dividends are stable and grow over time, which makes it a good choice for long-term investors.

How to Calculate Your SCHD Dividend Income

To calculate your SCHD dividend income, you need to know the number of shares you own and the current quarterly dividend payout. And to calculate your SCHD Dividend income you can follow the given formula.

Dividend Income = Number of Shares Owned × Dividend per Share

For example, if you have 100 shares of SCHD and the quarterly dividend payout is $0.60 then you will earn as a dividend on a quarterly basis:

100 shares × $0.60 = $60 per quarter

This means that you will receive $60 every quarter from your SCHD investment. Therefore if you want to estimate the annual dividend then you simply multiply the quarterly dividend by 4:

$60 × 4 = $240 per year

This amount would be your annual dividend income from 100 shares of SCHD, and I assume the dividends will remain at the same level.

Is SCHD a Good Dividend Stock for Passive Income in 2025?

Because of its strong dividend history, good performance and low expense ratio of 0.06%, SCHD is still a great choice for people looking for passive income in 2025. The 3.6% yield provides a good income stream and the ETF’s focus on high-quality, dividend-paying companies guarantees both income and long-term growth.

Also SCHD spreads your money across different sectors like healthcare, technology and consumer goods. This lowers your risk compared to buying individual stocks.

Factors That Impact SCHD’s Dividend Payouts

There are several factors that influence the SCHD’s dividend payouts and I am explaining the factors that you need to know about it:

- SCHD’s dividend yield could fluctuate depending on the ETF’s performance and the market environment. At the time of writing, SCHD’s dividend yield was approximately 3.5%. This rate is determined by dividing an annual payout by the share price of the ETF. You must know that the dividend yield is not set and can fluctuate with market conditions.

- SCHD holds high-quality U.S. dividend-paying stocks, mainly from industries like technology, healthcare and consumer essentials. The dividend payouts of these companies play an important role in SCHD’s overall dividend distribution. If the companies within SCHD’s portfolio increase their dividends then it will directly impact SCHD’s payouts.

- SCHD is designed for long-term dividend growth. Over the years SCHD has provided investors with a track record of increasing dividends. For example in 2024 the dividend for SCHD in 2024 was $2.01 per share. This was an increase from the previous year’s dividend of $1.92. This constant growth is a major point for investors.

- Economic factors like interest rates, inflation and market volatility may affect dividend payments. When the economy is in a downturn businesses may cut dividends to help maintain financial stability. This may alter the payout of dividends from SCHD.

- SCHD offers a Dividend Reinvestment Plan (DRIP) that allows investors to invest their dividends on a regular basis. Reinvesting dividends can increase gains over time by increasing the value for long-term investors.

Frequently Asked Questions

What is SCHD’s current dividend yield

×The dividend yield of the SCHD typically ranges between 3.5% and 4.0% as of 2025. This yield fluctuates based on the ETF’s performance and market conditions but it remains competitive as compared to the other dividend-focused ETFs.

How often does SCHD pay dividends

+SCHD pays the dividends in quarterly basis and they are mostly giving with distributions made in March, June, September, and December. This schedule allows you to receive regular cash inflows or reinvest your dividends through a DRIP (Dividend Reinvestment Plan).

How does SCHD compare to other dividend ETFs?

+SCHD stands out due to its strong yield and consistent dividend growth. As compared to the ETFs like VYM (3.0% yield) and DVY (3.5% yield) the SCHD offers you a higher yield and a more stable history of rising dividends, making it a preferred option for dividend-focused investors.

What factors affect SCHD’s dividend payouts?

+There are several factors that influence the SCHD’s dividends such as:

- The performance of its portfolio companies which primarily include large-cap U.S. dividend payers

- Economic conditions such as interest rates and inflation.

- Market volatility and potential cuts to dividends by underlying companies.

How do I calculate my SCHD dividend income?

+To calculate your SCHD’s dividend income:

- First of all you can do it by the normal formula i.e Dividend Income = Number of Shares Owned × Dividend per Share.

- For example, if you own 100 shares and the quarterly dividend is $0.60, you will earn $60 per quarter or $240 annually.

- Or you can also do it by using our SCHD Dividend Calculator where you do not need to take the burden of using formulas. And you will find it on the schdcalc.com

Is SCHD a good choice for passive income in 2025?

+Yes SCHD remains a solid option for passive income in 2025. It offers you a reliable dividend yield of approximately 3.6% and focuses on high-quality U.S. dividend-paying companies. Its diversification across different sectors helps you reduce risk and provides you stability even during market fluctuations.

What are the tax implications of SCHD dividends?

+If you hold SCHD in a taxable account you must pay taxes on the dividends. Qualified dividends are taxed at a lower rate (0%, 15%, or 20%), while non-qualified dividends are taxed at ordinary income rates. So to minimize your taxes then you must consider of holding SCHD in a tax-advantaged account like a Roth IRA.

What is SCHD’s expense ratio?

+SCHD has a low expense ratio of just 0.06%. This is beneficial for investors because it helps you maximize your returns by minimizing the cost of managing the fund.

How can SCHD provide diversification?

+SCHD invests in a diverse range of high-quality U.S. companies across sectors like technology, healthcare, and consumer goods. This broad diversification helps you reduce your risk as compared to investing in individual stocks and ensures you stability even during economic downturns.