Do you ever think about if there is a way to make your investment earnings work for you without you having to do anything? What if you could reinvest your dividends back into your stocks without doing anything? And for a long time it creates a snowball of wealth for you.

A Dividend Reinvestment Plan (DRIP) is a powerful strategy that allows investors to automatically reinvest their dividends to purchase more shares of the same stock. Instead of receiving cash payouts, investors use the dividends to acquire additional shares, often including fractional shares. This compounding mechanism leads to more shares, which in turn generate higher dividends, propelling long-term wealth growth.

So if you are a long-term investor then DRIPs provide you a cost-effective method by using the power of compounding. It is like putting your investments on autopilot so that you can grow over time without you having to do anything.

How Does a Dividend Reinvestment Plans Work?

If you are a beginner and you do not know properly how DRIP works in making the proper decision on your investment then you need to know how DRIP works.

1. Own Dividend-Paying Stocks

To benefit from DRIPs then you must first hold shares of companies or funds that give you dividends. The dividends are typically paid each quarter and are a part of the profits that a company shares with the shareholders. It is important to choose stocks/ETFs that have a history of paying regular dividends and also have a strong fundamental report.

2. Opt to Reinvest the Dividends

If you have dividend-paying stocks then you can reinvest them instead of receiving them in cash. The dividends you could receive are utilized to purchase more shares of the same stock or mutual funds.

3. Buy More Shares

DRIPs permit you to invest even tiny amounts. For instance, when your dividend payout isn’t enough to buy the entire number of shares or even a whole share then you can purchase fractional shares. This means that every portion of your dividend is still being invested which helps increase the value of your portfolio.

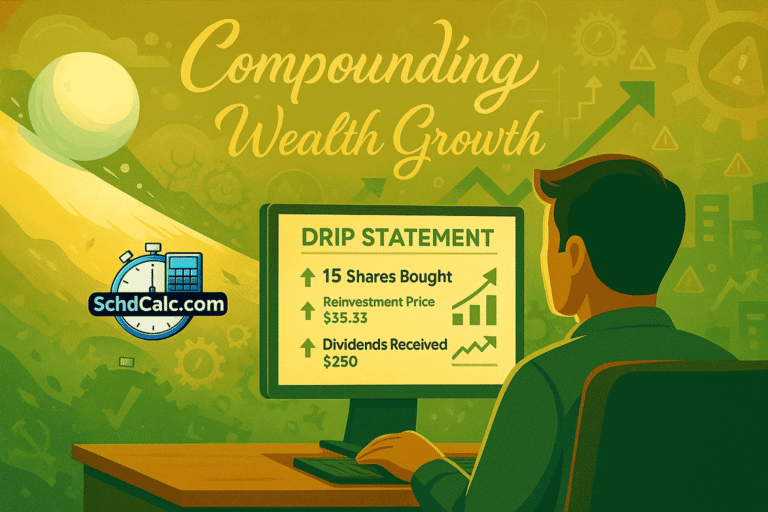

4. Let Compounding Work for You

The power of compounding lies behind DRIPs. When you invest your dividends, the number of shares you hold grows. That means the next time you receive dividends, you’ll be paid more shares which means you’ll be able to buy additional shares and the cycle continues. This will accelerate the growth of your portfolio without needing to do anything more than join the DRIP. So to understand the powerful impact of dividend reinvestment and see how your SCHD portfolio can grow exponentially over time, then you can use our interactive SCHD DRIP Calculator.

Pros and Cons of Dividend Reinvestment Plans (DRIPs) for Long-Term Investors

As with any investment strategy, DRIPs have their upsides and downsides. Here’s a look at both sides to help you decide if they align with your goals.

| Pros | Cons |

| 1. Automatic Growth: Once you set up DRIPs, your investment will grow automatically without the need for manual intervention. | 1. Taxable Dividends: Even though you’re reinvesting, dividends are still taxable income. |

| 2. Dollar-Cost Averaging: Since you’re reinvesting your dividends for long time then you’re buying shares at different prices which helps smooth out market volatility. | 2. No Immediate Cash Flow: If you need cash from your dividends, you won’t receive any with DRIPs—they are reinvested. |

| 3. Fractional Shares: You can reinvest small amounts and still buy partial shares which means you’re always making your money work for you. | 3. Record-Keeping: Keeping track of fractional shares and cost basis can get tricky over time. |

| 4. Low Fees: Many companies offer DRIPs with no commission fees which means that more of your money is put to work rather than paying transaction costs. | 4. Limited Flexibility: Once you’re enrolled in a DRIP, you can’t easily change your investment strategy without selling shares. |

How to Start a Dividend Reinvestment Plan

A. Through Your Brokerage (Synthetic DRIPs)

Most investors in 2025 will find that the easiest and most common way to join a DRIP is through their brokerage firm. It is also known as “synthetic DRIPs” because the brokerage firm reinvests your amount for you instead of the company itself. There are a few important benefits that you need to know.

1. Centralised Management:

You can manage all of your eligible DRIPs from one brokerage account which makes it easy for you to keep track of everything.

2. Wide Eligibility:

Brokerage-offered DRIPs usually help you reinvest in a wide range of securities such as individual stocks, Exchange-Traded Funds (ETFs) and mutual funds. So when you reinvest your securities that means you have diversified your investment.

3. Fractional Shares:

Modern brokerage platforms allows you to buy some fractional shares so that you can invest small amount put every penny of your dividend money to work, even if it’s not enough to buy a full share.

4. Ease of Enrollment:

Now you enrol your investment by checking a “reinvest dividens” box in the settings for each eligible holding from your online brokerage account.

5. Optional Cash Purchases (OCPs):

Many platforms allow you to buy more company stock (OCPs), such as fractional shares, directly through their trading interfaces, and often commission-free, etc. This has mostly made the need for separate “Share Purchase Plans” (SPPs) within the traditional DRIP structure less important.

B. Directly Through the Company (Traditional DRIPs)

Although some companies but fewer still now provide direct enrollment in the DRIPs. And the DRIPs are usually managed by the transfer agent. Usually in this method you will get the enrollment forms by calling the company’s investor relations department and also the requirement of the “registered shareholders”. This method usually needs investors to be “registered shareholders,” rather than “beneficial shareholders” who own shares through a brokerage account. Because DRIPs offered by brokers are easy to use and have many benefits and so modern investors usually do not want to enrol directly with a company.

Key Features and Advantages of Modern DRIPs

A Dividend Reinvestment Plan (DRIP) allows investors to automatically use the money that they have earned from dividends to buy more shares of the same fund or company. This is a smart way to grow your investment without doing anything extra. Here I explain the key features of modern DRIPs and why it is good for investors today.

1. Fractional Share Investing:

Here you do not have to buy a whole share of a company. Suppose if I give you an example like the share price of the stock is $100 and you only have $50 in dividends and using your dividends you can still buy half a share. But in the past, it was not like that to buy some portion of your stock from your dividend. And this way you can use all of your dividend income to buy more shares even if it is less than one whole share.

2. Integration with ETFs and Robo-Advisors:

As you may know that DRIPs can now also work with ETFs (Exchange-Traded Funds) and robo-advisors. These are the tools that invest for you without you having to do anything. For example if you invest in a fund like the Schwab U.S. Dividend Equity ETF (SCHD), the DRIP will automatically use the dividends you earn to buy more shares of that ETF. This makes it easier for you to invest your funds into things without having to do much work.

3. Easy Tracking:

It used to be hard to remember how much you paid for your shares because you were buying small amounts of stock. But now it is easy for you and thanks to modern brokers. They send you reports that show you exactly how much you paid for each share and they take care of your taxes for you so you do not have to worry about it.

4. No More Paper Stock Certificates:

In the past when you bought stocks, you got paper certificates that proved you owned those shares. But today with the help of brokerage accounts you can hold your stocks electronically and thanks to modern brokers. This makes it easy for you because you do not need to worry about losing paper certificates or becoming a “registered shareholder.”

5. Dealing with Company Changes:

It can be hard to deal with when a company splits into two or merges with another. But now you do not have to worry about these changes because modern brokers take care of them for you.

Dividend Reinvestment Plans (DRIPs) are a great tool for you if you are a long-term investor, and they help you automatically increase your growth and benefit from the compounding power of dividends. Therefore when it automatically reinvests your dividends to buy more shares then you can accelerate your process of building your wealth for a long time.

Frequently Asked Questions

How do DRIPs work for beginners?

×You need to have stocks or mutual funds that pay dividends in order to use DRIPs. Then you decide to reinvest the dividends instead of getting them in cash. Your dividends that you reinvest are used to buy more shares including fractional shares which can help your portfolio grow faster over time.

Are dividends from DRIPs taxable?

+Yes you have to pay taxes on the money you get from DRIPs. You still have to report dividends on your taxes in the year you get them even if you reinvest them. Also the dividends you reinvest may change your cost basis which could affect your capital gains when you sell the shares.

What are the tax implications of using DRIPs?

+If you get dividends through DRIPs then you have to pay taxes on your dividends. You might also have to pay capital gains tax when you sell the shares you bought with DRIPs. This tax depends on how long you’ve owned the shares. If you keep them for more than a year then you pay a lower tax rate on capital gains.

How do DRIPs differ from cash dividends?

+Cash dividends give you immediate income in a right away which helps you use it however you want. However they are taxed like regular income. DRIPs on the other hand, focus on long-term growth by reinvesting the dividends to buy more shares. This can lead to faster compounding and lower capital gains tax rates.

Are DRIPs a good investment strategy?

+If you want steady growth and compounding benefits then DRIPs are a good choice for long-term investors. But they might not be the best choice for people who need money right away or want to be able to change their plans. DRIPs can be a great choice if you want to build wealth over time.

How do I enroll in a DRIP?

+To enroll in a DRIP you must follow the given information:

- Pick stocks or mutual funds that pay dividends.

- Verify from your broker or the company directly to see if the DRIP option is available.

- Choose to automatically reinvest your dividends.

- Long-term reinvestment process to grow your portfolio.